risks associated with closed end funds

The Allspring Income Opportunities Fund is a closed-end high-yield bond fund. Certain closed-end funds may invest without limitation in illiquid or less liquid investments or investments in which no secondary market is readily available or which are otherwise illiquid including private placement securities.

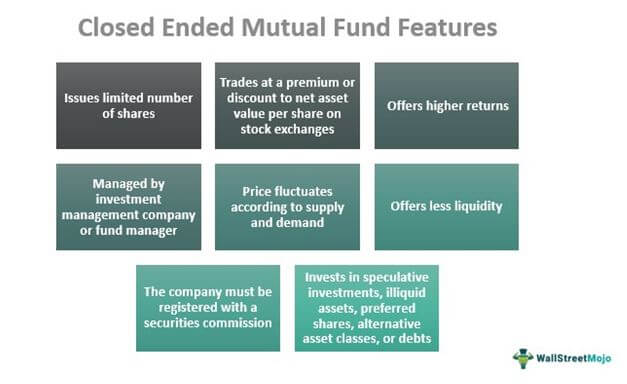

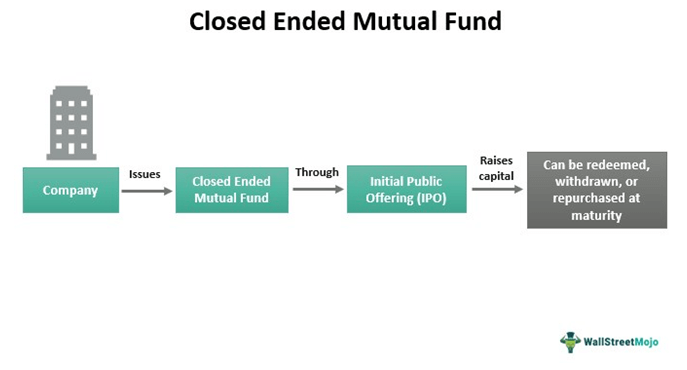

Closed Ended Mutual Fund Meaning Examples Pros Cons

The Allspring Income Opportunities Fund is a closed-end high-yield bond fund.

. The Allspring Income Opportunities Fund is a closed-end high-yield bond fund. GDVPK is a closed end fund focused on US. Restricted and Illiquid Investments Risk.

The fund has total returns as a primary investment objective. CEF values can drop due to the overall movements in the financial markets. On the following pages we provide an overview of how leverage works strategies used to create leverage and their inherent costs as well as the potential benefits and risks that leverage entails.

Shares of closed end funds in secondary markets are. Closed-end funds or CEFs are funds that manage money gathered from. What are the risks associated with Closed-end Funds.

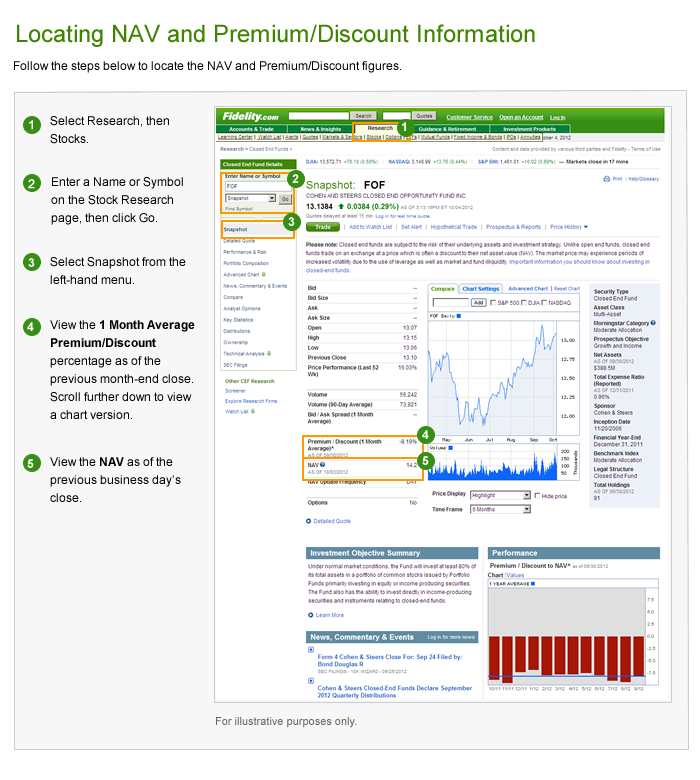

Paying a Premium or Discount. Risks associated with investing in closed-end end funds generally include market risk leverage risk risk of anti-takeover provisions and non-diversification. Since market demand determines the price level for closed-end funds shares typically sell either at a premium or a discount to NAV.

For closed end funds that hold fixed income securities in their portfolios the risk can be significant. Like any investment product closed-end funds come with a range of risks which well cover next. A closed-end fund or CEF is an investment company that is managed by an investment firm.

Closed-end funds are traded on the open market. Because closed-end funds have a fixed asset base they can more easily buy illiquid investments investments that are traded less frequently or are difficult to quickly buy and sell. Closed-end funds are more likely than open-end funds to.

Access Alternative Credit Through CEFs BDCs and REITs with HYIN from WisdomTree. And this was typically historically this has typically been from preferred shares or from debt. Market Risk Of Capital Loss Similar to open-end funds closed-end funds are just as susceptible to market fluctuations and volatility.

The risks associated with a closed-end fund are outlined in the prospectus. Small- and mid-cap securities may be subject to special risks associated with narrower product lines and limited. Access the Nasdaqs Largest 100 non-financial companies in a Single Investment.

Ad This Alternative Income ETF Seeks to Provide Income While Managing Effects of Rising Rates. Small- and mid-cap securities may be subject to special risks associated with narrower product lines and limited. Ad Choose From Hundreds Of No Transaction Fee Mutual Funds.

In addition shares of many closed-end funds frequently trade at a discount from their net asset value. Expense ratios or the cost of owning the fund each year may also be lower compared to some open-end funds. GDV exhibits remarkably robust long.

The Gabelli Dividend Income Trust NYSE. Most closed-end funds use leverage in an effort to enhance the funds return income or both. Closed-end funds generally do not impose trail commissions or 12b-1 fees which are assessed against the account annually as many mutual funds do.

Ad See how Invesco QQQ ETF can fit into your portfolio. CEFs can also more easily borrow money against their asset base with the borrowing leading to financial leverage. Small- and mid-cap securities may be subject to special risks associated with narrower product lines and limited.

In addition each closed-end fund is subject to specific risks that vary depending on its investment objectives and portfolio composition. Securities in a portfolio of a closed-end fund may decline in value and the closed-end fund may not achieve its intended objective. Closed-end funds pool investors capital during an IPO period invest in stocks bonds or other securities according to an overall investment objective.

Open An Account Today. Managing the risks associated with leverage. Risk Of Rising Interest Rates.

Credit Risk Credit risk is the risk that the issuer of a security will default or unable to meet its obligations to pay interest or principal as scheduled. Please see each products web page for specific details regarding investment objective risks associated with hedge funds alternative investments and other risks performance and. What are the risks associated with Closed-end Funds.

Closed End Fund Cef Discounts And Premiums Fidelity

Difference Between Open Ended Funds Vs Close Ended Funds

Capital Protection Oriented And Dual Advantage Mutual Funds Mutuals Funds Investing Fund

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

What Are Closed End Funds Fidelity

Mutual Fund Amentals A Visual Guide Mintlife Blog Personal Finance News Advice Finance Investing Mutuals Funds Investing Money

Pin On Investing In Mutual Funds

Closed Ended Mutual Fund Meaning Examples Pros Cons

Closed Ended Mutual Fund Meaning Examples Pros Cons

What Are Closed End Funds Fidelity

Difference Between Open Ended Funds Vs Close Ended Funds

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Difference Between Open Ended Funds Vs Close Ended Funds

Understanding Closed End Vs Open End Funds What S The Difference

:max_bytes(150000):strip_icc():gifv()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

/155571944-5bfc2b9646e0fb005144dd3f.jpg)

/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)